elitefts™ Sunday edition

Opportunity Cost

Making Money versus Creating Value

If a company is repeatedly profitable, is it creating value? Some would unequivocally say yes, but as Lee Corso might say – “Not so fast my friend.” Profitability is defined by reported earnings, which for US public companies is based on GAAP, which has more gray areas than a 70 year-old biker’s beard. Duh, you say, we all know that earnings are able to be manipulated and cash flow is king.

So, if a company is repeatedly generating positive cash flow, it must creating value, right? Maybe. But maybe not. Far too often capital investments are justified and business valuations are accepted that don’t appropriately account for what might be the most important comparative variable – the opportunity cost.

Opportunity cost is the value you forgo in order to allocate finite resources to a particular endeavor. If I am investing in the stock of Company A, then I forgo the opportunity to invest in other companies. When selecting from a universe of companies with similar risk profiles, my goal is to pick the one that will generate the highest cash flow and create the most value.

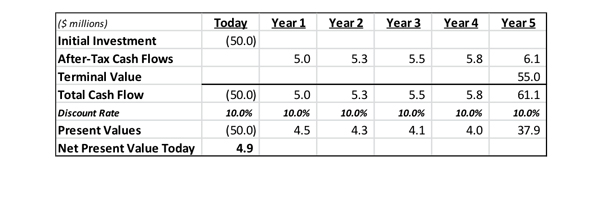

The corporate financial analysis world accounts for opportunity cost by applying some cost of capital to form a net present value cash flow analysis. This cost of capital is typically going to be something called a Weighted Average Cost of Capital (WACC), which is a combination of returns required by debt and equity investors in order to fund all capital in the business. By comparing the initial cost of an investment against the expected future benefits (discounted at the cost of capital), you can determine if it makes financial sense. The following examples illustrate the math assuming two different businesses acquired today for $50 million, held for five years with cash flow growing at 5% per year, and then sold for $55 million.

Case 1

In Case 1, the cost of capital used to discount the cash flows is 10%, the net present value is positive, so from purely a financial standpoint the investment is justified:

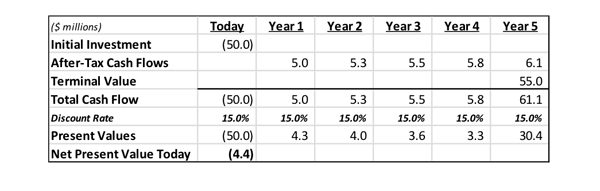

Case 2

In Case 2, the target company is inherently more risky than Case 1 and requires a 15% discount rate be applied. What this basically says is that other companies with similar risk profiles provide a weighted return to all investors of 15%. In this case, the net present value is negative. Even though the cash flows themselves are identical between Cases 1 & 2, the decision has gone from Yes in Case 1 to No in Case 2 simply because of the higher opportunity cost associated with the riskier investment. If pursued, it would destroy value even though it after generating significant positive nominal cash flows.

I’m Bored – What Does This Gibberish Mean to Me?

Yes, the previous few paragraphs were boring as shit. As much as I wanted to work in a joke about bloat, crossfit or raw youtube gym benches, it just didn’t fit. The point of it all is to prompt the question of whether you are metaphorically just making a little money and achieving sub-maximal results with your training or are you creating real value.

Every training cycle you use Program A is a cycle you are not able to use Programs B, C or D. If Program A is not creating maximal gains relative to the other programs, you are destroying value relative to your true potential (and possibly relative to your competitors).

Similarly, every session that is half-assed or cut short causes you to forego a session that could be done balls-to-the-wall from front to back. Making a habit of this shortcutting will certainly destroy value in the training sense. And by habit, I mean more than a couple times every 3-6 months.

This concept is also something for which I don’t have a direct answer. The best program for you today may not be the best program for you in the future as you progress as a lifter. Even going balls-to-the-wall every session may have drawbacks if you have other factors impacting rest and nutrition outside of the gym. But, it had better be something that permeates your lifting over time.

The key is to constantly evaluate whether what you are doing is creating value. Is there a better conditioning routine to improve my hill sprint times? Can I improve my diet plan to get to 10% bodyfat instead of 12%? Will my constant trolling on outlaw forums in advance of my next meet make that 20 lb PR a 40 lb PR? These are all questions that you need to figure out over time by consistent and intense time under the bar.

Training

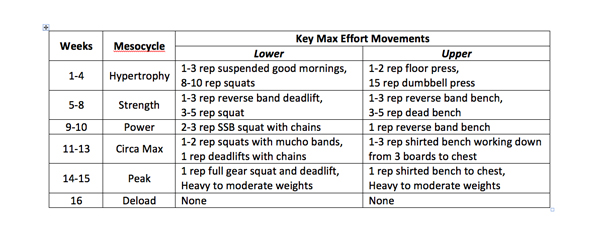

The dicking around between training cycles has now concluded and meet training is in the early stages. Between-cycle training is good in that it affords time to experiment with things that don’t traditionally fit in a meet plan. But, it is nice to be focused on a goal again and pushing the envelope, injuries be damned (as opposed to being focused on improving conditioning and preparing the body for meet training – which includes not getting injured as a primary goal). I am currently in the second week of a 16-week block training cycle that is structured as follows:

Other than my wife running the monolift, training will be done mostly solo in the garage (those Spud straps better work because I don’t think her slightly-built frame will be catching any dumped squats). Shirted bench work is also difficult to get in without spotters, which is why I am relying on reverse bands more than I normally prefer.

One thing I will be doing consistently this time around is filming, reviewing and asking others to review video of my lifts. I almost injured myself badly collapsing under a squat in the last meet because I got in the habit of not pushing my knees out hard. This is something that could have been caught and corrected if I had been reviewing form via video regularly.

Looking Ahead

The immediate future will consist of meet training and a trip to London, OH for the next Learn to Train Seminar. The next MBA Meathead installment will be an update on how things are progressing and hopefully an entertaining view on life in Corporate America. If anyone has anything that bothers them about cubicle-land, let me know in the comments section. Until next time, keep your squats above parallel and when in doubt, add more gear.